Thin markets, as defined by Nobel laureate Alvin Roth, are characterized by scattered buyers and sellers with difficulty finding each other and low probability of random matching due to variety in needs and offerings. The economic research reveals these markets suffer from fundamental inefficiencies that AI-driven platforms can directly address.

“Thick Markets (e.g., Amazon) are Familiar and Well Understood

The key aspect of a thick market is that most or all of its activity is standardized. Standard packaging, standard pricing, standard delivery, etc. If you can imagine that a market would work well with Magento or Woocommerce, that probably means that the market could be made decently thick. Maybe not as thick as Amazon or the stock market, but buttoned down enough that conventional database-driven automation would likely work.

- Transactions are extensively standardized

- Item specifications

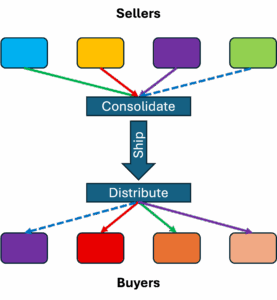

- Consolidation

- Fulfillment

- Distribution

- Payment

- Tracking

- Risk is low – Deals are guaranteed and/or insured

A Huge World of “Thin Markets”

Thin markets are far more numerous than thick ones. From one perspective, any market should be considered thin unless automation has successfully made it thick. Among existing, operational thin markets, most exhibit significant inefficiency and dysfunction. Unless a way is found to more thoroughly standardize parts of them, they are likely to remain that way. There are also many thin markets that don’t actually exist as such. They are too challenging for anyone to try to operate. These “latent” markets might be very useful if someone could figure out how to build them but, for now, they are intriguing visions or hopes. Characteristics that make thin markets difficult are summarized below.

- Item exchanged is nuanced and hard to fully describe.

- Item has significant value and high risk if transaction fails

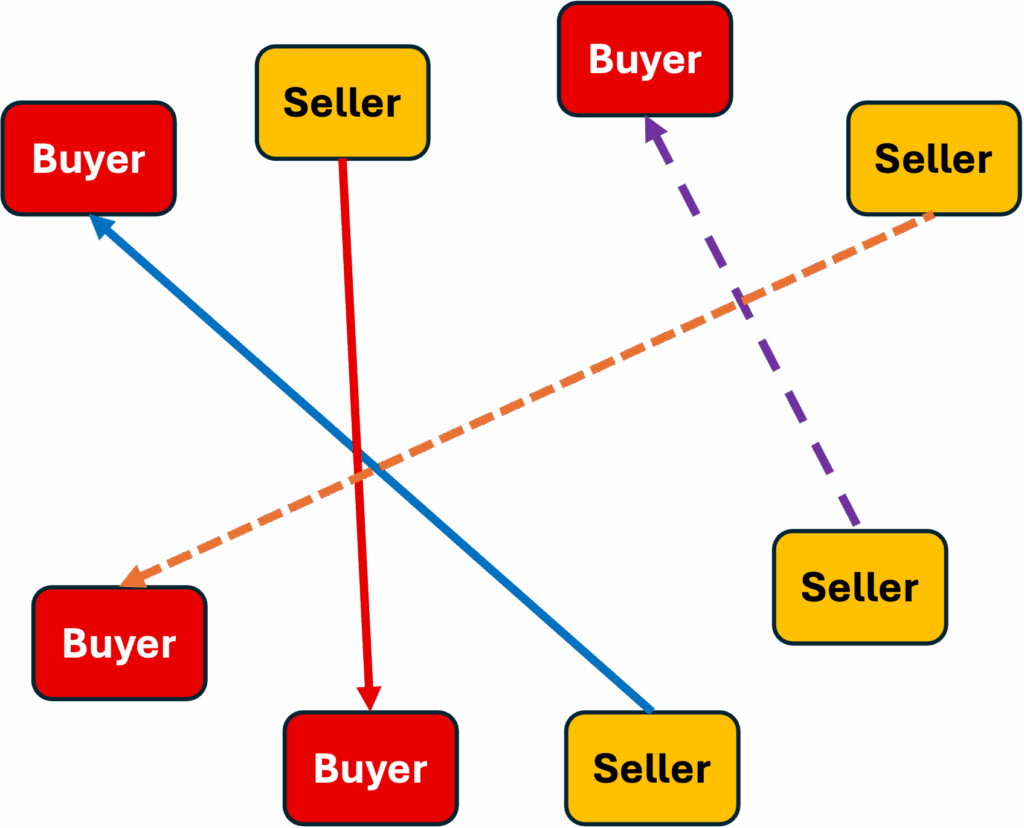

- Buyers and Sellers don’t know each other or maybe even know whether the other party exists

- Individual items may be unique and not easily compared to other offerings

- Fulfillment depends on a specific combination of buyers, sellers, items and locations. There may be thousands or millions of different combinations.

- Pro tip: Thin markets that do exist are often run by human “brokers”

- Key feature: Little or nothing is standardized

Comparing Thick and Thin

A more nuanced view would see most markets as having mixtures of thin and thick characteristics. Ebay and Etsy have some residual thin characteristics, but most of the serious impediments are handled by the automation. The combination of information (photos, videos and rating scores) and the generally modest price points mean that many buyers are willing to take the risk.

| Characteristic | Thick Market | Thin Market (and Why) |

|---|---|---|

| Number of Participants | Many buyers and sellers; easy to find matches | Few participants → harder to connect Often due to remote geography or niche needs |

| Liquidity | Deals happen quickly; prices stable | Transactions slow, prices jumpy Worse when buyers/sellers are scattered |

| Match Probability | High chance of finding the right partner | Low chance of good match Diverse needs, distance, or weak digital skills |

| Barriers to Entry | Easy to join and engage | Hard to enter Foreign buyers unknown; sellers lack digital reach |

| Price Stability | Stable prices; benchmarks clear | Volatile prices Few offers, weak benchmarks |

| Search & Communication | Efficient, supported by digital tools | Slow, fragmented Limited internet literacy; distance hampers trust |

The AI Challenge

The irony with thin markets is that the needed information for successful exchange probably already exists, but it isn’t in a standardized form that conventional IT can use.

The question that DeeperPoint is trying to explore is whether AI can organize the unstructured info into sufficiently standardized data? Will that be enough to effectively “thicken” an otherwise Thin Market?